VOL. 27, #4, Winter 2009

Vivid Pink Sells For $10.8 Million, Auction Reports, Notable Quotes, Victoria's Secret $3 Million Bra, Gem Heists, In The News

- Home

- Newsletter

- VOL. 27, #4, Winter 2009

Vivid Pink Sells For $10.8 Million, Auction Reports, Notable Quotes, Victoria's Secret $3 Million Bra, Gem Heists, In The News

Vivid Pink Sells For $10.8 Million

by Robert G. Genis

A rare, 5.00 carat, cushion vivid pink, GIA graded, VS1 diamond was auctioned for $10.8 million in Hong Kong in early December. Although its presale estimate was $5.1-$7.13 million, it sold for $10.8 million. The color is described as a rich bubble gum pink. The stone is potentially internally flawless. The diamond was found in South Africa and was set in an 18k gold and platinum ring flanked by two white diamonds. It was set by jewelers Graff Diamonds.

The Bidding

The diamond toured Singapore, Bangkok, Geneva and Taipei before returning to Hong Kong, where it was auctioned at the Convention and Exhibition Center. An anonymous Asian buyer placed the winning bid via telephone through a Christie's representative. He beat out Shanghai millionaire Liu Yiqian, who ranks 196th on Forbes' list of the richest people in mainland China.

Price History

The highest price paid previously at auction for a pink diamond was $7.4 million in 1994 for a 19-carat, rectangular-cut stone auctioned in Geneva. The world's most expensive colored diamond ever sold at auction is the "Wittelsbach" blue diamond, a 17th-century deep grayish-blue stone that fetched $24 million last year. The 5.00 vivid pink gem's per-carat price of $2.2 million was also the highest ever paid for any diamond at any auction.

How could a stone sell for so much during a gem market which was badly hit by the financial crisis?

Twenty four billionaires made the Forbes magazine list annual ranking of the richest people in China in 2008. In 2009, the number jumped to seventy nine. The total net worth of China's 400 richest surged 81%, while America's wealthiest lost 20% of their cumulative total over the same period. In 2009, eight out of the ten most expensive gems were acquired by discerning Asian private collectors, confirming once again Hong Kong's position as the major market for the finest gemstones. Not all gems sell in Asia, including a 72.22 carat D-Flawless white diamond that failed to hit its reserve price in a Sotheby's Hong Kong sale last April, falling short of its $10-12 million pre-sale estimate. Perhaps this diamond was too common for Asian collectors.

There is no shortage of cash-rich investors in Asia. Sentiment in the gemstone market is particularly positive. This is a reflection of abundant liquidity of US dollars and wealth in Asia, and in particular China, since mainland Chinese investors were strong participants in the auction.

Larry Warsh, a longtime art collector and founder of Museums Magazines, stated "If you're selling any asset today, you have to think of Asia," he says. "That's where the action is, that's where the power is, that's where the wealth is."

Conclusion

The Chinese stock market has been strong in 2009 and their economy seems to be humming along, even though some financial experts doubt the Chinese government's numbers. If you were a wealthy Chinese, would you rather buy more US Treasury debt or a rare pink diamond? With soaring US budget deficits as far as the eye can see, the buyer of this stone chose the latter. Asian collectors have always coveted gemstones. Unless the Chinese economy goes south, we see nothing in the future to deter this trend.

Auction Reports

Christie's Hong Kong

In addition to the Vivid Pink, several other interesting stones sold in Hong Kong.

9.03 carat oval, VVS1 clarity, fancy vivid yellow diamond sold for over $1.5 million. It was set in a ring by Graff and mounted with pear-shaped diamonds. Its top presale estimate was $1.2 million. A pair of 8.52 and 8.39 carat pear-shaped fancy yellow internally flawless diamond earrings sold for slightly above $560,000, which was within estimates.

Jade also sold at the auction. A rare jadeite diamond pendant necklace sold for $700,000. A pair of jadeite and diamond ear pendants fetched $189,000. A pair of three-colored jadeite bangles sold for $282,000. All sold within their estimates. A carved jadeite Metteyva Buddha, also referred to as the Laughing Buddha or Buddha with a Big Belly, with a pre-auction estimate $750,000 to $1 million, did not sell.

A round, 16.99 carat, D-Flawless, GIA graded diamond sold for over $2.9 million.

Christie's Geneva

Christie's "Jewels: the Geneva Sale," was held Nov. 18 at the Four Seasons Hotel des Bergues in Geneva. Overall, the auction sold 82 percent by lot and 93 percent by value. The sale was over $32 million during the two-day auction.

A 19.13 carat briolette-cut is the largest recorded "chameleon diamond" in the world. The stone was graded fancy grayish-yellowish-green. Chameleon diamonds are diamonds that react to heat or dark storage by temporarily changing color from grayish green to yellow when they are heated, cooled or kept in the dark. Mounted as a pendant, it sold for a record $987,000 or $35,000 per carat to a European dealer. Other colored diamonds sold were a 65.20 carat fancy intense yellow, cushion-shaped which sold for nearly $1.04 million, and a 4.42 carat fancy intense, square-cut green diamond, which sold for $783,000. A 24.92 carat pear-shaped light blue, VVS2 diamond, mounted in a ring by Cartier, sold for over $1.5 million. This diamond, well over the high estimate, was bought by a European trade member.

A 62.30 carat, D-Flawless diamond went for slightly over $8 million. Russian born Aleks Paul of Essex Global Trading in New York paid $130,000 per carat for the 62.3 carat diamond. Paul also submitted the top bids for two natural color diamonds. Paul bid $2.68 million for a diamond ring by Wolfers that paired a 3.30 carat, rectangular-cut, fancy intense blue diamond and a 3.90 carat E, VS2 diamond. This was far above the presale value of $580,000 to $740,000. Finally, Paul came up with nearly $2.6 million for a fancy vivid, fancy intense and fancy blue diamond clasp, circa 1950, which had an estimated value of $500,000 to $650,000.

The most important colored gem was 7.03 carat oval-shaped Burmese ruby set in a diamond cluster ring by Laurence Graff sold for $1.13 million to a private Asian buyer.

Sotheby's Geneva

Sotheby's Magnificent Jewels sale was held in Geneva on November 17. The auction sale generated almost $37 million with 79 percent sold by lot.

The key piece was the Roxburghe Rubies. The suite of rubies are mounted in a necklace with 24 cushion-shaped rubies (21 were said to be Burmese) and 25 cushion diamonds. The 5th Earl of Rosebery is believed to have purchased the necklace from Garrard Jewelers of London. The necklace and earrings were a present for his wife, Hannah, who passed it down to her daughter, the Marchioness of Crewe. She then gave it to her daughter, Mary, Duchess of Roxburghe. It sold for $5.7 million, five times the high estimate and a world-record price for a ruby suite.

A 2.52 carat, vivid green diamond sold for almost $3.1 million to a private Asian buyer. A 6.63 carat fancy pink, cushion-shaped diamond fetched $1.4 million. Both were within the presale estimate range.

Swiss jeweler Chatila bought a 74.80 carat, fancy vivid yellow diamond: a cut-cornered, rectangular, modified brilliant-cut stone that was mounted in gold, for $3.1 million, which fell within the presale estimate range. Chatila also acquired a 3.17 fancy intense blue, brilliant-cut diamond ring for over $2.5 million, within its presale estimate.

Sotheby's New York

Sotheby's sale of Magnificent Jewels brought a total of slightly over $30 million, or 88% sold by lot and 91% by value.

The top price was a D-Flawless oval diamond, weighing 30.48 carats, which sold for over $4.1 million or $134,990 per carat.

One high point was the offering of magnificent jewels from the collection of former Brazilian model and philanthropist Lucia Moreira Salles. Stones of interest to collectors included an approximate 27 carat cabochon Colombian emerald mounted in platinum and diamond ring. Purportedly the emeralds were formerly in the private collection of King Farouk of Egypt sold for $524,500. Also, an approximate 16.30 carat sugarloaf cabochon Burma ruby mounted in platinum and diamond bracelet brought $410,500.

Two exceptional Cartier bracelets also sold. First, a 1923 featuring Colombian cabochon emeralds weighing approximately 70 carats and old European-cut diamonds weighing approximately 9.50 carats, mounted in 18 karat gold and platinum, which totaled $458,500. Second, a Ruby and Diamond Bracelet, circa 1925, set with cushion-shaped and oval Burmese rubies weighing approximately 62 carats and diamonds weighing almost 10 carats, which sold for $590,500 .

A Fancy Intense 11.05 Yellow Diamond by Tiffany & Co. doubled its presale high estimate to sell for $818,500.

Christie's NY

Christie's "New York Jewels" and the "Magnificent Jewels" sales was $25.18 million, with 85 percent of the goods sold by lot and 97 percent sold by value.

A 39-carat, D color diamond from India's famed Golconda mines called the "Evening Star" fetched $5.4 million at Christie's. An anonymous buyer snapped up the stone, paying $138,000 per carat for the diamond dubbed the "Evening Star" because its previous owner liked to wear it out at night.

A 7.02 carat modified rectangular-cut fancy intense blue, VS1 diamond went for $3.89 million to an anonymous buyer and 40.92 modified cushion-cut, fancy intense yellow diamond was auctioned off for $1.11 million.

Notable Quotes

"After the crisis from last year onwards, I found that more collectors are looking for top quality jewelry and diamonds for the investment to keep the value and also for sale. So for rare stones like this, even for pink, yellow, blue red, green - these rare stones are very popular in this market."

Vicky Shek, Christie's Hong Kong Jewelry Division

November 27, 2009

New Tang Dynasty Television

"We know people over 55 treasure diamonds but that's not so clear for the Ipod generation."

Tim Dabson, a DeBeers executive director

November 16, 2009

Wall Street Journal

"When times are tough, hard assets like diamonds are in greater demand because they will hold their value when inflation hits - and it will hit."

Jeweler Myles Mindham

December 4, 2009

The Globe and the Mail

Victoria's Secret Bra

Italian Jeweler Damiani designed a $3 million Black Diamond Harlequin Fantasy bra for Victoria's Secret for Christmas. The design took over 100 hours and 800 hours of labor to make it.

Supermodel Marisa Miller wore the undergarment with 2,300 white and brown diamonds. The largest stone is a 16 carat heart shaped brown diamond. For those interested, the bra can be worn in five ways: strapless, halter, crossback, one-strap or classic. Last year's bra was $5 million and the main diamonds were black. Perhaps the more modest bra is a sign of the bad economic times or the negative social mood.

YouTube Video: Victoria's Secret Fashion Show Fantasy Bra

Gem Heists

Pink Panther' jewel thieves sentenced in Serbia

Associated Press

Dec 18, 2009

By Dusan Stojanovic

Three Serb members of the infamous "Pink Panther" ring of thieves were convicted of Japan's biggest-ever jewel heist, which nabbed treasures including a $27-million (euro19-million) diamond necklace.

A Belgrade court found the three guilty in their second trial of stealing $31.5 million worth of jewels from an upscale shop in Tokyo in March 2004. The jewels have never been found.

Aleksandar Radulovic was sentenced to six years and nine months in prison and Djordje Rasovic received six years and three months, while Snezana Panajotovic got two years and ten months in jail.

The two men, Rasovic and Radulovic, used force during the robbery, and Panajotovic held guard in front of the jewelry shop, Judge Milena Rasic of Serbia's organized crime court said.

The court has said the three were part of the "Pink Panther" ring named after the 1963 film starring Peter Sellers as the bungling Inspector Clouseau. The group is believed to be mainly from the Balkans, and is suspected of several jewel thefts worth more than $150 million in Europe, Asia and the Persian Gulf.

The three convicted Friday were ordered to return the 125-carat necklace, two diamond earrings and seven diamond rings - or pay the equivalent of their total value in Serbian Dinars.

The second trial was held after their lawyers appealed the original verdicts. The prison sentences handed down Friday were slightly lower then those in the original ruling in 2007. The three were arrested in Belgrade in 2005 on an international warrant and charged in Serbia after Japan agreed that the trial would be held in Serbia.

A fourth suspect, a British woman, was not on trial in Belgrade. The agreement between Japan and Serbia only covered the trial of Serb citizens.

ESU student accused of setting up robberies via Craigslist

By JD Malone and Stephen J. Novak

The Express-Times

November 26, 2009

Pennsylvania - An East Stroudsburg University in student used ads on Craigslist to arrange robberies, police said.

Corey Jackson, 21, of the 900 block of Main Street, East Stroudsburg, used the name Dale Faison to set up sales or buys of items listed on the popular, free classified advertising site.

Instead of dealing in good faith, police said, he robbed a local couple of a ring in Bethlehem Township and attacked a man in Bethlehem and stole $1,400.

Philadelphia police eventually turned the tables on Jackson in September during a sting operation using a phony Craigslist ad.

Jackson was arraigned Tuesday on charges connected to the local cases. He was sent to Northampton County Prison in lieu of $75,000 bail in each.

In the Bethlehem case, police say Jackson agreed to meet Jeff Tran at midnight April 3 in the 400 block of Montclair Avenue. Jackson promised to sell Tran an Apple laptop computer for $1,400.

After exchanging cash for the computer, Jackson told Tran to follow him back to his car for the warranty information, police said. He then doused Tran with pepper spray and wrenched the computer from his hands.

According to a police affidavit, Dale and Barbara Gardner met Jackson in a Wachovia Bank parking lot in Bethlehem Township on July 24 to sell him a diamond/sapphire white gold 3.35 carat ring, valued at $2,300 they had advertised on Craigslist.

Jackson talked to the couple for about 30 minutes and asked to see the ring, police said. He fled after it was given to him.

A few days later, police received a call from Craig Forchetti of New Hope who said he read a newspaper account of the crime, the affidavit said. Forchetti said he had also advertised a ring sale on Craigslist and arranged a meeting in Philadelphia with a man later identified as Jackson.

Jackson pulled the same stunt on Forchetti as on the Gardners, police said.

Forchetti said he contacted Philadelphia police, who were setting up a phony ring sale. Jackson was caught by city police Sept. 15 when he tried to steal a ring during the decoy sale, police said.

In the local cases, Jackson was charged with two counts of robbery, theft and receiving stolen property and one count of simple assault.

Jury convicts head of Diamond District hijack ring

National Jeweler

December 15, 2009

The man who authorities say was the leader of a crew that spent years looting New York City's Diamond District by hijacking delivery trucks at gunpoint was found guilty on all counts in federal court on Monday.

After a one-week trial, a jury convicted 57-year-old Hector Rivera, of Hollis, Queens, on a slew of federal charges stemming from incidents that occurred between 2002 and December 2008, according to a press release from the U.S. Attorney's Office for the Southern District of New York. The charges include three counts of robbery or attempted robbery that involves interstate or foreign commerce--a violation of the Hobbs Act--one count of conspiracy to commit Hobbs Act robbery, and two counts of using and carrying a firearm during a crime of violence.

The conviction means Rivera will likely spend the rest of his life in prison. Each of the robbery charges carries a maximum sentence of 20 years in prison, and, on top of that, Rivera would have to serve additional time for each of the firearms charges: the first carries a sentence of seven years to life, and the second has a mandatory minimum sentence of 25 years and a maximum sentence of life in prison. Together, the six charges also carry a maximum fine of either $250,000 or twice the gross gain or loss from the offense, whichever is higher.

Rivera is scheduled to be sentenced before U.S. District Judge Harold Baer Jr. on April 8, 2010, at 11:00 a.m.

Considered the ringleader of a robbery and extortion crew that often used firearms and targeted companies in the Diamond District over a six-year period, Rivera was one of a dozen men arrested last year in connection with the December 2007 hijacking of a Federal Express truck full of diamonds.

On the evening of the arrest, prosecutors say, the group was poised to pull off a second robbery on Dec. 4., 2008. Among the 12 taken into custody along with Rivera that night was diamond dealer Brian Greenwald, identified as president of Doppelt and Greenwald Diamonds. According to court records and the U.S. Attorney's office, Greenwald pleaded guilty in the case, but details on his sentencing were not available.

According to the release, Rivera was also convicted of the Nov. 29, 2005 robbery, at gunpoint, of a wholesale diamond business located at 580 Fifth Ave., the building that is the main hub of diamond district activity. In addition, he was found guilty of the Dec. 20, 2007 robbery of a FedEx truck and possessing and brandishing a gun during that robbery, as well as the attempted hijacking and robbery of a second FedEx tractor-trailer truck on Dec. 4, 2008, the night the crew was arrested.

The bungled robbery in December 2007 seemed to be the beginning of the end for Rivera and his crew. According to the release, on the night of Dec. 20, 2007, near 48th Street and 11th Avenue in Manhattan, two men displaying firearms and police badges approached the driver of a FedEx truck believed to contain several million dollars worth of diamonds.

The driver was removed from the truck at gunpoint, then handcuffed and kidnapped, as the two men drove the truck to a loading dock in Brooklyn, N.Y. The defendants, however, were unable to unload the contents of the truck and later abandoned the vehicle, releasing the driver after holding him for four hours, the release states.

According to the release, authorities learned of the second hijacking, for Dec. 4, 2008, that was being planned by Rivera and others through the use of surveillance, consensually recorded phone conversations and in-person meetings between Rivera and a cooperating witness, as well as court-authorized taps on two cell phones.

Prior to Dec. 4, 2008, Federal Bureau of Investigation agents observed, among other things, Rivera and another defendant driving past a warehouse on New York's Long Island, a warehouse which the witness previously had pointed out to Rivera as being a good place to off-load the contents of a hijacked truck, the release states.

Intercepted wire and electronic communications between Rivera and others revealed, among other things, that Rivera was involved in recruiting people to participate in the planned robbery, according to the release

In The News

Diamonds are a girl's best friend; The science of precious stones

Bangkok Post

11/11/2009

By David Canavan

As the leading line from the movie says:

Men grow cold

As girls grow old,

And we all lose our charms in the end.

But square-cut or pear-shaped,

These rocks don't loose their shape.

Diamonds are a girl's best friend.

Diamonds Are A Girl's Best Friend

by Marilyn Monroe in the 1953 movie,

Gentlemen Prefer Blondes

I can't imagine that there is a human being out there who doesn't appreciate precious gemstones. Minerals, especially in the form of gemstones, are some of nature's most beautiful creations. The scientific study of their chemical and physical properties, and how they form, is known as mineralogy.

One subdivision of mineralogy is the scientific identification, classification, evaluation and appreciation of gemstones, known as gemmology. And in Thailand, there are many gemmologists, because Thailand has many gemstones among its rocks, many traders of precious stones, and many customers willing to buy. Accordingly, Thailand is a gemmologist's dream come true!

How are gemstones formed?

Gemstones are formed over millennia under intense heat and pressure. Geological processes produce certain conditions under which, if the correct minerals are present, gemstones are formed. There are three rock types: Sedimentary, metamorphic and igneous. Of these, gemstones are formed in igneous and metamorphic rocks.

Gemstones are a combination of different elements in a compound that has the correct properties that crystallise and form colours and reflections of beauty. Gemstones are formed deep underground as that is where conditions are right for the crystallisation process.

Igneous crystals are formed when magma, the hot molten layer of rock under the Earth's crust, cools and solidifies in gaps, or fissures, in the Earth's crust deep underground. The magma, which comes out as lava from volcanoes, is a rich soup of minerals that can give rise to untold numbers and varieties of gemstones.

If the magma finds a gap to cool down, crystallisation occurs and gemstones are formed. The stone type, colour and quality of a gem will be determined by what minerals are present while the magma cools. The incredible depths where the gems are formed means that there is tremendous pressure, which also aids in the formation of precious gems. The fact that they are formed so deep underground and are, therefore, subjected to intense heat and pressure, also aids in a gem's formation.

The slow cooling that forms inside the Earth's crust allows large crystals, or gemstones, to be formed. When lava is produced, the mineral-rich, molten rock cools really quickly and forms very small crystals in rocks such as basalt.

Metamorphic rocks are not as common in the gemmology world as igneous rocks are, but the intense heat and pressure can lead to crystallisation and gemstone formation.

Diamonds can be formed through the metamorphic process (basically enormous heat and pressure of igneous or sedimentary rocks), and carbon-based objects will form diamonds under such heat and pressure.

Jade is also another example of a metamorphic gemstone, although the majority of others you can think of are predominantly igneous. Some, though, can be formed through metamorphosis.

Precious and semi-precious

These are ancient terms used to classify gemstones, based on the rarity of the stone. Diamonds, rubies, emeralds and sapphires are the original "precious" stones, while all other gemstones are semi-precious, although a lot has changed in the gemmology world since these ancient terms were invented.

Thailand and neighboring Burma have huge deposits of sapphires and constantly provide excellent specimens. There are also newly discovered gemstones that have only recently been classified. One of the newest, and in my opinion, the most beautiful, is tanzanite, a blue stone from the hills of Mount Kilimanjaro in Tanzania.

In all reality, if you own a precious or semi-precious gemstone, you are in ownership of a piece of the Earth that has been in formation over millions of years. All stones are precious to me, and they should be to you, too.

Diamonds

Diamonds are in a league of their own in the precious gem world. Diamonds are made exclusively of the element carbon, although other "impurities" can create various colour varieties.

Diamonds are the hardest natural substance. They have a refractive index of 2.4 compared to 2.1 for cubic zirconium and 1.5 for glass.

What this basically means is that light refracts (bends) enormously in diamonds due to its density, when compared to glass and cubic zirconium. If the "cut" is right, that is, the number of facets (which are small, flat windows) a diamond has, a high refractive index can bend white light (sunlight) in all directions and disperse the colours of white light, leading to diamonds having its special sparkle, star-like quality, or fire.

Sapphires

Sapphires are a common, yet much-sought-after gemstone in Thailand, as they are mined extensively here, especially in Kanchanaburi province. They are also mined in many other countries throughout Asia, yet interestingly, their mineral composition can determine exactly which region in which country the stones were mined from.

Although most people associate them with the colour blue, sapphires can come in a variety of colours. The colour we see is the reflected visible light range from a band of colours in the EM (electromagnetic) spectrum in the visible light range. That is, if the violet, blue, yellow and green end of the spectrum is absorbed but the red is reflected, then the stone appears red.

This is the case with red sapphires that have the special name ruby. Essentially though, regardless of whether a stone is a ruby or a sapphire, it is made up primarily of the compound aluminium oxide.

Apart from the red-coloured sapphires known as rubies, sapphires can also be pink, purple, deep blue, light blue or even green and colourless. Their colour is determined by the trace elements in the aluminium oxide compound, so if it contains the element chromium, rubies are the result.

If a sapphire contains vanadium, darker blue and purple stones result. Rarer, pink sapphires have high levels of chromium and are beautiful stones, but the classic, light-blue coloured sapphires are the most sought after and generally more expensive stones, and they are of such a colour due to the presence of iron and titanium.

But whether pink, gray, green, red or blue, sapphires are nonetheless amazing and are in the corundum family of stones, which are the hardest known substance next to diamonds.

As long as the mining of gemstones is ethical and regulated, a gemstone's preciousness is in no doubt. They are nature's most wonderful creation and have formed over millennia. So, regardless of whether the gemstones are precious or semi-precious, look after them properly and appreciate them!

De Beers finds out that diamonds aren't forever

The Guardian UK

December 6, 2009

by Richard Wachman

The diamond industry has been hammered by the recession, with prices down by as much a third over the past year. No company has felt the pain more deeply than South Africa-based De Beers. Analysts estimate that its production will fall by around 50% after a collapse in sales in 2009, amid a slump more severe than most people can remember.

At the height of the slowdown earlier this year, De Beers closed all four of its mines in Botswana because the "sightholders" - independent diamond-factory businesses that buy rough diamonds and cut, polish and sell them on to the retail trade - that it dealt with were being starved of credit by the banks. Its workforce has been reduced by 23%, with payroll numbers down from about 20,500 to just under 16,000 in 12 months, with thousands of miners made redundant.

Profits fell 99% to $3m (£1.8m) in the first half, while borrowings stand at $3.5bn. De Beers needs to refinance $1.5bn of debt by 10 March 2010, but lenders are understood to be demanding punishing interest rates as the price of a restructuring deal.

But an agreement with its three main shareholders should give the company increased bargaining power with the banks. Its biggest investors - mining group Anglo American, the diamond-entrepeneur Oppenheimer family and the government of Botswana, have agreed in principle to subscribe to a $1bn rights issue, raising much-needed cash to cut the group's indebtedness.

For years, De Beers was the diamond industry, speaking for 90% of world production. But new players from Russia, Canada and Australia have entered the market, reducing its dominance.

Competition authorities in the EU and the US have also clamped down on the company's ability to control prices and supply by restricting its rights to sell on behalf of other diamond producers.

In South Africa itself, the company has cut investment, while diversifying abroad to hedge against the political uncertainties unleashed by the ending of apartheid 15 years ago. Nicky Oppenheimer, the Harrow-educated chairman of De Beers, was obliged to sell 26% of the company to a black empowerment group under legislation passed by the African National Congress.

Like others, De Beers has taken account of the changing reality by ring-fencing its South African operations inside a company called De Beers Consolidated Mines and moving its capital abroad.

But it is still the world's single biggest diamond producer, at 40%, and remains a force to be reckoned with. It owns shops in world capitals such as London and New York and is behind a huge worldwide marketing operation designed to prop up demand for diamonds. The language on its website is both compelling and gushing. "For thousands of years diamonds have been valued for their beauty and rarity, entrancing us with their fire and brilliance. Symbols of power and inspiration, diamonds are also a token of love and personal expression of our hopes for the future."

But consumers have lost their appetite for the gems, which has serious implications. About 90% of rough diamonds end up being bought by ordinary punters in their polished form; industrial consumption of diamonds is relatively small.

De Beers drastically cut production to support a price recovery, with output of 1.1m carats in the first quarter down 91% year-on-year. Many mines have now reopened as the worst of the slump appears to be over, but De Beers cannot escape the chill winds of recession. In the US, which accounts for about half of world consumption, retailers are taking a big hit. Tiffany has seen profits drop by 75%, while 1,000 jewelers across America have gone out of business. Neither are the macroeconomic signs encouraging: US unemployment may not peak until 2011 and home foreclosures are not expected to peak until late 2010.

The slump in US demand reverberates to places such as India, where thousands of workers in diamond polishing factories have been laid off. About 60% of diamonds cut and polished in the Indian state of Gujarat are sold to the US, with the region accounting for more than two-thirds of the international processed-diamond industry.

De Beers has been forced to seek fresh streams of revenue. Recently, it launched a global campaign to convince investors that diamonds are an alternative to gold as a safe investment. But analysts and investors say that the closed nature of the diamond market made them a much less attractive option than gold.

Brock Salier, mining analyst at Ambrian, a London-based resources investment bank, admits the uncertainty that has gripped equity and currency markets had sparked demand for "hundreds of millions of dollars of something they can stick in a vault" such as diamonds. But he warns they represent a much riskier investment than bullion. Traded through auctions and private tenders, the stones have no public market price and there is no instrument investors can use to hedge against fluctuations.

Despite a rebound in rough diamond prices in the past two months, Des Kilalea, a diamond analyst at RBC Capital Markets, reckons that 2010 "will be challenging, although, like most things, the industry's fortunes turn largely on what happens to the global economy".

But the green shoots of recovery are coming through: Rio Tinto is saying it will shortly restart expansion work at its Argyle diamond mine in Western Australia. De Beers reported recently that rough diamond prices were heading up, but were still well down on the highs of 2008, while sale trends at its marketing arm were improving. A spokesman said: "We've seen strong demand for rough diamonds since the half year which has meant we've canceled planned Christmas shutdowns at our operations in Canada and reopened one of the mines in Botswana earlier than planned."

Now that prices are picking up again, there are hopes that Christmas, the most important time of the year for jewelry retailers, won't be as bad as last year.

A spokesman for the Antwerp World Diamond Centre says: "A diamond is a luxury product, and that's what people tend to skip from their list. With the recession easing, we're hopeful the festive season could prove a turning point."

But in hard times, no one is displaying unbridled optimism.

Diamonds Hold Allure As Gem of an Investment

The Wall Street Journal

December 1 7 , 2 0 0 9

By Laura Santini

Despite the financial meltdown, luxury assets such as wine and art are drawing strong interest from rich buyers, some looking at the goods as investments. Now, promoters of diamonds are hoping to add the precious stones to the investment mix.

Record sales at recent auctions, set by Asian bidders, is spurring talk of a surge in high-end diamond demand. Several investment funds focusing solely on diamonds have launched or are in the works and are hoping to take advantage.

Asian bidders, especially from mainland China, represent a growing presence at auctions, says Patti Wong, chairwoman of Sotheby's Asia. At a Sotheby's auction in New York City earlier this month, five of the top 10 buyers were Asian.

The most expensive item -- a 30.48 carat oval diamond -- went to a buyer from mainland China for approximately $4.11 million. At a Christie's auction in Hong Kong this month, a colored diamond, called "The Vivid Pink," sold for $10.8 million, setting a record for a gemstone of its kind.

It's unclear if the buyers were after the rocks for investment purposes or simply to enjoy. But proponents are hoping to turn diamonds -- traditionally seen as ornaments -- into wealth-accumulating vehicles.

The advent of online venues for trading polished white diamonds has improved price transparency needed to enhance liquidity and make possible the launch of diamond investment funds, says Saul Singer, principal of London-based Fusion Alternatives, a money manager specializing in diamond investing. (Polished white diamonds are the most commonly traded for investment purposes and serve as a sort of diamond benchmark.)

Fusion plans to start an investment fund, either as a listed vehicle on the London Stock Exchange's Alternative Investment Market for small companies or as a private equity-type fund. In March, Cayman Islands-based KPR Capital Ltd. created an open-ended diamond fund for investors willing to put up a minimum $250,000 in capital.

But investors should be cautious if they think diamonds will necessarily hold their value or appreciate. While Mr. Singer says increased demand in China and elsewhere has limited supply of some types of stones, he acknowledges that the diamond supply is dominated by a small, tight-knit group of diamond producers who carefully control supply, at times shutting down mines.

Others also caution buyers against acquiring diamonds solely for investment purposes. Ms. Wong of Sotheby's says that polished white diamonds may hold their value, but that trading in these gems for investment purposes remains unproven, as the retail trade is much larger. Diamond trading for investment purposes hovers between $500 million and $750 million annually compared to about $20 billion overall, according to Fusion's data.

At $3,164,000, iPhone 3GS Supreme is the single most expensive phone in the world!

Intomobile

November 30th, 2009

By Dusan Belic

|

|

Here's one of those phones I'll never have. Scrap that, it's one of those phone I'll never see in real-life. It's the Stuart Hughes-made/customized iPhone 3GS Supreme, where the "Supreme" part comes from its price, which is a whooping $3,164,000 (1.92 million GBP). Yap, that's more than 3 million US dollars, which is enough to make almost 2 miles of a highway.

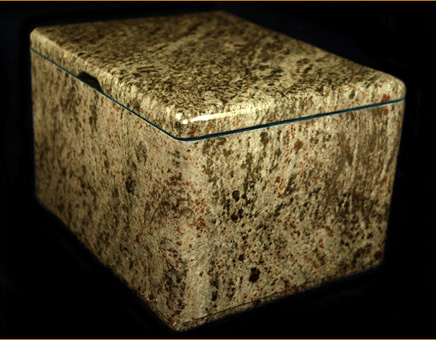

Feature wise, it comes with 271 grams of 22k gold, 136 flawless color F diamonds for the bezel, 53 diamonds for the logo, and a single 7.1 carat diamond for the home button. All this comes in a chest that is made out of single block of Granite, in Kashmir gold with the inner lined with Nubuck top grain leather, weighing 7kg.

As for the real specs, the Supreme "version" is identical to the original iPhone 3GS, and honestly folks, if someone you know wants to buy this, tell him/her to Colorware its iPhone and put the rest of the remaining $3.163.800 in some charity. That makes much more sense!