VOL. 27, #1, Spring 2009

Tucson Gem Show 09, Collectors Universe Exits Gem Business, ISG Withdraws from AGTA, Notable Quotes, Weird Engagement Tales, In The News, Retail Gemstone Price Trends (1975-2008)

- Home

- Newsletter

- VOL. 27, #1, Spring 2009

Tucson Gem Show 09, Collectors Universe Exits Gem Business, ISG Withdraws from AGTA, Notable Quotes, Weird Engagement Tales, In The News, Retail Gemstone Price Trends (1975-2008)

Would the Tucson Gem Shows be affected by the economy? That was the million dollar question as the shows approached with the backdrop of the world being in the greatest financial contraction since the Great Depression. The number of gem dealers attending increased, however, buyer attendance was down. This is the only show in memory where you could get a hotel room or rent a car during the months of January and February. Getting a restaurant reservation was not a problem. Nothing had changed as far as the gem market goes. Unheated Burma rubies and sapphires were as rare as ever. The same type of stones that were available last year were for sale again this year. What changed was the buyers had smaller budgets. If dealers did 50%-70% of last year's sales, they were happy. One major dealer's sales were down 97%. Overall, there were plenty of lookers but few serious buyers.

AGTA Leave Tucson?

The largest wholesale show is the AGTA at the Tucson Convention Show. Attendance was down almost 20% from last year. Officials of AGTA and Tucson City managers spoke about the lack of action by Tucson on the Rio Nuevo Development, which includes a new arena and hotel. The Convention Center where the show is held is a joke. Plus, there are serious parking, hotel and transportation issues. Losing the gem show would cause a $100 million loss to the city of Tucson.

Burma Goods

The Burma Democracy Promotion Act of 2007 has successfully stopped the importation of Burmese gemstones into the US. We have not heard or seen of anyone bypassing the new law. The law does not affect any Burmese gemstones that are presently in the country, so people are free to trade in these old stones without problems. Once these old stones are gone, Burma stones will become as rare as Kashmir sapphires.

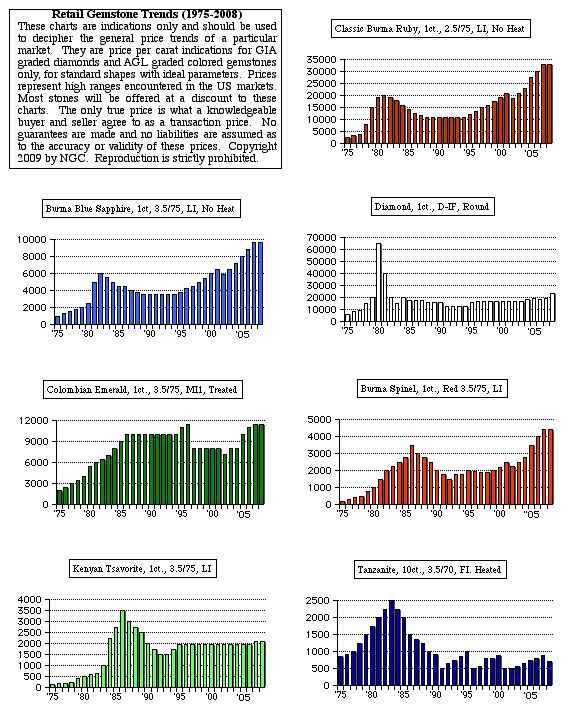

Gem Prices

Given the weak economy, we expected to see prices down across the board. This was true in a sense. Commercial quality goods were down 30%, reflecting the general deflation in the economy. However, prices for rare investment/collectible gems were not down in price. As one dealer told us, "First, I cannot replace these goods because of the Burma ban. Why should I sell something for less than I paid and I cannot replace it?" Although demand may have weakened for these goods, prices have not. We are keeping most of our Retail Gemstone Price Trends the same for most gemstones from last year. The weakest stone we monitor is Tanzanite, down approximately 25% from last year and D-IF diamonds rose slightly.

Bottom Line

Fine gemstones are not rising because of the world economic condition. However, they are not declining either. Many collectors/investors worry the Obama deficits and rising money supply spell real inflation in the near future and are beginning to diversify into hard assets. Others see gemstones as the ultimate crisis hedge or portable store of wealth. They want some money in gemstones just in case. Some are stashing their cash, rare coins, bullion coins, silver, colored gemstones and colored diamonds as an insurance hedge. Remember, gemstones are not for everyone. They make sense only if you have the liquidity to hold these assets.

Collectors Universe Exits Gem Business

On March 2, Collectors Universe, announced it has decided to exit the business of authenticating and grading diamonds and colored gemstones.

Michael Hayes, Chief Executive Officer, stated, "We incurred impairment charges with respect to our jewelry businesses at June 30, 2008 and again at December 31, 2008, due to the severity of the economic recession and the worsening of the credit crisis in the United States and the resulting uncertainties as to the level of revenues we could expect from our jewelry businesses in future periods. The continuation and possible extension of these economic conditions has led us to conclude that it is unlikely these businesses will be able to achieve the goals we had established for them when we first acquired those companies. As a consequence, management and the board of directors have decided to exit the jewelry businesses, which will enable us to give full attention to and focus our significant resources, energy and liquidity on our core businesses in collectibles, where we have decades of experience and a proven record of success."

The company used to own and operate both the Gem Certification and Assurance Laboratory (GCAL) for diamonds and the American Geological Laboratory (AGL) for colored gemstones but opted to drop both labs. GCAL founder The Palmieri Group, led by lab President Don Palmieri, opted to buy back the lab and keep it in operation.

|

|

C.R. "Cap" Beesley, ex-president of AGL |

Christopher Smith, the former vice-president of AGL, has reached an agreement in principle with Collectors Universe, to reopen the lab. There have been many rumors about Cap Beesley. Some contend Mr. Beesley is retiring. From the conversations The Gemstone Forecaster has had with Mr. Beesley, we can tell you Mr. Beesley will start a new laboratory. There are many issues involved in which remain confidential at this time. Either way, colored gemstone clients can rest assured they will be able to get their gemstones graded in the near future by Mr. Beesley.

In his first official statement, C.R. "Cap" Beesley, ex-president of American Gemological Laboratories (AGL) clarified his current status with respect to the laboratory. He stated, "I want to make my position absolutely clear, I am not affiliated or connected with American Gemological Laboratories (AGL) in any way or in any capacity" In addition, Beesley further indicated, "I want to put to rest any rumors about retirement, the word is not in my vocabulary and I have no intention under any circumstances of riding off into the sunset".

Interestingly, Michael Hayes is scheduled to resign as CEO of Collectors Universe on April 1, 2009. We suspect there is a connection between Collectors Universe pulling out of the gemstone markets and Mr. Hayes departure.

An investment firm backed by Roy Disney (the nephew of the Walt Disney Co. founder) is urging Collectors Universe to sell the company. Collectors Universe shares are down about 60% this year. Disney believes the company is worth twice as much as its market value of $30 million. Burbank-based Shamrock Capital Advisors Inc., which owns 9% of Collectors Universe, says Collectors Universe should sell and abandon its "flawed strategic vision." The investment firm called Collectors' profit track record "simply dismal."

The ISG withdraws our membership in the AGTA!

EDITOR: Here is the AGTA resignation letter written by Robert James, President, International School of Gemology. Never bashful, Mr. James puts in on the line why he no longer wants to be a member of AGTA. It was edited for space.

With this newsletter the International School of Gemology and our community members wish to inform the American Gem Trade Association that we are formally withdrawing our membership from the AGTA. The reasons for this action are numerous and onerous. Although the ISG has made every conscience effort to work within the situation, we find ourselves caught between what is ethically proper for the industry, and trying to fit in with an organization whose Board of Directors has continually proven themselves at be at odds with the concepts of ethics, fair business dealings, and consumer protection. Indeed the AGTA's stated purpose is to protect its dealer members, and to our experience that includes protecting its dealer members who are perpetrating deceptive trade practices on the consumers.

The AGTA Andesine Connection

As early as 2006, AGTA CEO Doug Hucker was informed about potential diffusion treatment problems with the andesine being imported by AGTA member Ande Gem and Mineral Co. Mr. Hucker made the conscience decision to do nothing about that warning. In the ensuing years the AGTA Gem Testing Center provided scores of AGTA GTC Identification Reports verifying the andesine as natural and untreated. Only years later when confronted by the evidence provided by the ISG did some of those who signed the AGTA reports admit that they "did not know" if the material was treated or not. And yet without knowing exactly what they were looking at, these folks signed off on the AGTA GTC Identification Reports as the andesine being all natural, which helped to further the lack of proper disclosure being perpetrated on consumers as verified by a report from Jewelry Television.

AGTA member Ande Gem and Mineral Co.

The ISG specifically asked Doug Hucker to investigate the connection between AGTA member Ande Gem and Mineral Co regarding the andesine problem. A document in the ISG office from Jewelry Television verifies that it was Ande Gem who was the main supplier for the andesine labradorite being sold to Jewelry Television that became the focus of the class action suit.

Indeed, in communications with Julie Chen of Ande Gem and Mineral Co, we asked her about the andesine treatment and she responded with feigned bewilderment at the concept on several occasions, and refused to consider our information on the possible diffusion treatment of andesine. Only later did we get the document from Jewelry Television that showed that Ande Gem was the main supplier of the andesine to JTV. And once again, when we tried to inform the AGTA CEO Doug Hucker about the problem he provided us double talk and no action. To date, no action has been taken regarding Ande Gem and Mineral Co. participation in the events leading up to the JTV andesine class action. Nor for the AGTA GTC Identification Report's place in the scheme, for that matter.

The true AGTA is no more

I was working in this industry in Dallas when the AGTA was formed. I know a great number of the AGTA founding members. All of those folks have left. What has happened is a small group of powerful dealers have taken over the name and legend of the original AGTA founders and turned it into a special interest organization whose purpose is to protect its largest and most influential members at all costs

.and regardless of what antics they pull on the industry.

This is not the purpose of the ISG or our community. And we will no longer stand for it. We will no longer be a part of this nonsense.

Yesterday the AGTA GTC gave a report on an "unexpected find" of a dyed tourmaline. Thereby taking full credit for the discovery, and leaving out all reference to the work of the ISG regarding this issue.

This perhaps speaks to a greater volume the situation we are faced with regarding the AGTA than anything else. Subterfuge at every turn is what we have received from the AGTA.

Effective immediately the ISG withdraws our membership in the AGTA. We urge the ISG community to do so also with a letter to the following:

Doug Hucker, CEO

American Gem Trade Association

3030 LBJ Freeway, Ste. 840111111

Dallas, Texas 75234

I will end this by saying that our stance is not toward any individual AGTA member.

I regret and apologize that the ISG has worked so hard to bring our community into the AGTA membership. And I apologize to the members of the ISG community for having brought you into this mess.

Effective immediately the ISG withdraws our membership in the AGTA.

Robert James FGA, GG President, International School of Gemology

"To many, the ruby is the most valued gemstone. It is said to represent passion, beauty and prosperity. In the Bible, Job said, "The price of wisdom is above rubies." Solomon said, "A virtuous woman is more valuable than rubies." The most valuable shade of the ruby is pigeon blood, mined in the Mogok valley of Myanmar."

VR Narayanaswami

livemint.com

March 2, 2009

"Colored diamonds have held their value and not suffered from the current economical crisis as other traditional assets have."

Mahyar Makhzani

Rapaport

February 18, 2009

Weird Diamond Engagement Tales

Fiancée swallows engagement ring

|

|

Reed Harris placed his girlfriend's engagement ring in a milkshake and planned to film her excitement when she found it. This is a twist on giving your fiancé a ring in a wine or cocktail glass. Unfortunately, Kaitlin Whipple, 20, managed to swallow the diamond whole as she raced friends to finish their dessert at Wendy's. The couple, from Farmington, New Mexico, eventually ended up at hospital where an x-ray confirmed what had happened. Harris then got down on one knee, presented his girlfriend with a copy of the scan and proposed. Two days later, the ring finally reappeared. The couple is planning on getting married in June.

78K Diamond Flushed, Then Found

In Phoenix, a $78,000 engagement ring fell from Allison Berry's hand when she flushed the toilet in the restroom of the Black Bear Diner on Jan. 14. The ring plopped in and the water whisked it away. City workers opened a pipe outside the restaurant and continuously flushed the toilet, hoping to push the ring out to the opening. When that didn't work, the city called the office of Mr. Rooter, a plumbing services franchise based in Waco, Texas. "This is going to be like dredging for a treasure chest in the ocean," said Mike Roberts, general manager of Mr. Rooter. Roberts guided a tiny video camera into the pipe with an infrared light attached. He eventually spotted the ring just 3 feet down and 5 feet over from where it was flushed. Then it took an hour-and-a-half of jackhammering and pipe removal before Roberts and a technician could recover the ring, eight hours after it fell in the toilet. The Mr. Rooter bill came to $5,200 and the city's bill was $1,000. Her fiancé also tipped Roberts and the technician $400 each and gave $200 to a diner employee for staying late. "They always say diamonds are a girl's best friend. In this case, a plumber is a girl's best friend," Roberts said.

How an Emerald, 840 Pounds of It, Landed in Court

L.A. County Sheriff Has the Big Rock Many Claim to Own

Wall Street Journal

By Tamara Audi

March 3, 2009

EDITOR: This would be a great movie!

Just before Christmas, detectives from the Los Angeles County Sheriff's Department pried open a crate outside a warehouse to find something they had been chasing for months: an 840-pound Brazilian emerald that had been reported stolen.

Now, if they could just figure out who owns it. So far, at least five people have come forward to say it's theirs.

"It seems like the more we talk to people, the more people claim to have ownership over this thing," said Lt. Thomas Grubb, who heads the sheriff's investigative team on the case. "We haven't determined who's not a suspect, really."

Unable to determine who the real owner is, Lt. Grubb decided to keep the emerald locked up while the investigation proceeds. Meanwhile, a Los Angeles civil court is scheduled to hear from different claimants in the case on Tuesday.

Lt. Grubb, who had spent the bulk of his 26-year career conducting narcotics investigations, first got onto the case last September. A distraught man named Larry Biegler had called the sheriff's office to say that his giant emerald had been stolen from a Los Angeles-area warehouse where he had been keeping it. It was worth nearly $400 million, he said.

Lt. Grubb's detectives began investigating.

The emerald, they determined, was in the possession of two businessmen named Todd Armstrong and Kit Morrison, whom detectives tracked to a small town called Eagle, in western Idaho. When the detectives arrived in Eagle, Mr. Armstrong was in the process of trying to sell the emerald to a buyer. "We've run into a small snag," Mr. Armstrong says he told his buyer.

The Idaho men said the emerald belonged to them. They said in an interview they paid Mr. Biegler $1 million for diamonds he never delivered. Mr. Biegler had put the emerald up as collateral, they say, for the stones. When the diamonds didn't materialize, they picked up the emerald from the warehouse in Los Angeles. They showed investigators a stack of documents they said prove their claim.

Mr. Biegler -- a gem broker and real-estate investor -- disputes that account. He says he kept up his end of the diamond deal, and claims the Idaho men agreed to pay $80 million for the emerald, which he was willing to sell at that price.

The Idaho men agreed to turn over the emerald to the sheriff's deputies until the matter could be resolved. But the emerald wasn't even in Idaho. Mr. Armstrong and Mr. Morrison had placed it in a secured warehouse in Las Vegas for safekeeping.

Lt. Grubb began to organize an excursion to Las Vegas. On the morning detectives drove to get the emerald, he told his deputies: "We're going to stop on the way and get breakfast. We're going to pick up a $400 million piece of evidence. On the way back, we're not stopping."

When Lt. Grubb finally laid eyes on the emerald, he said, "It almost didn't look real."

Those who have seen the emerald describe it as a black boulder with protruding arm-sized green crystal cylinders. Gem experts say unbroken crystals of that size are rare. Such a large specimen usually would not be broken down into smaller pieces for jewelry. It would more likely be sold intact to a private collector or a museum. An appraisal done in Brazil valued it at $372 million, according to documents filed with the Los Angeles court.

However, George Harlow, curator of minerals and gems for the American Museum of Natural History in New York, says that the most impressive mineral specimens might bring a price of up to six or seven figures. "But nine figures? I'm unaware of any mineral specimen that's ever gone for that much money."

So far, the Bahia emerald hasn't sold for a fortune. But it definitely has been around. The emerald was first dug up from a mine in 2001 in Bahia, in eastern Brazil. Bahia emeralds are among the oldest on Earth, formed two billion years ago, according to the Geological Institute of America.

The emerald's first owners were a Brazilian gem trader, who owned the rights to the mine, and his business partner. In 2005, they shipped the emerald to a business associate in San Jose, Calif., named Ken Conetto, according to claims made in court documents filed by Mr. Conetto. Mr. Conetto says he kept the emerald stored in San Jose while attempting to find a buyer. He did not pay for the emerald, but he agreed to share some of the profits with the Brazilians, he says.

From San Jose, Mr. Conetto sent the gem to New Orleans, where he thought he had a buyer lined up. When Hurricane Katrina hit, it flooded the warehouse where the emerald was being kept, Mr. Conetto says. The emerald was submerged for weeks, and the sale was never concluded. The emerald returned to San Jose.

Mr. Conetto enlisted Mr. Biegler to help him sell the emerald.

They thought they could find potential buyers in Los Angeles. So last June, they loaded the rock into a van and drove it down themselves, Mr. Conetto said. Halfway through the trip, the van broke down, leaving the two men and their emerald stranded somewhere on Interstate 5. They rolled into a motel. Mr. Conetto said they paid the motel's owner and her boyfriend to help load the emerald into another van.

Eventually, it made it to Los Angeles County, where it sat in a warehouse.

But things began to sour between Mr. Biegler and Mr. Conetto, according to both men. Mr. Biegler says he took possession of the stone after Mr. Conetto pledged it as collateral on a loan he failed to pay.

Mr. Conetto says he never actually borrowed the money and that the emerald is still his.

It's not uncommon for gems to be used as financing tools for business deals, passed back and forth on paper among brokers while never leaving a vault. That can lead to multiple parties using a jumble of documents to claim rights to the same gem.

Meanwhile, new claims continue to emerge. Anthony Thomas a gem trader from outside San Jose, says he is the rightful owner of the emerald because he purchased it for $60,000 from the Brazilians in 2001. Mr. Thomas has also filed a claim in Los Angeles superior court.

On Tuesday, the court will begin hearing the competing claims of ownership. The emerald, however, remains locked up in the sheriff's custody.

"I'm going to write a nonfiction book on this," Mr. Armstrong says. "But I'm going to have to sell it in the fiction section because nobody will believe it's true."

Myanmar: Whom do sanctions hurt?

IHT

By Stanley A. Weiss

February 20, 2009

EDITOR: Finally, a voice of reason on the United States embargo against Myanmar.

Watching President Barack Obama's inauguration from my hotel room in Yangon, in Myanmar, I doubted whether his promise of change was meant for Myanmar as well.

U.S. relations with this country have stagnated for years, as Washington strives to sanction the country's brutal leadership into submission. Meanwhile, the misery of Myanmar's 54 million people deepens by the day.

Yet, the ice may be cracking. This week, U.S. Secretary of State Hillary Clinton declared that Washington "is looking at steps that might influence the current Burmese government" and "ways that we could more effectively help the Burmese people."

Meanwhile, Nobel laureate Aung San Suu Kyi's party, the National League for Democracy, issued a statement of willingness to begin dialogue with the regime without preconditions.

But it is time to admit that the regime's full acquiescence to U.S. demands is not a requirement for improving people's lives. That does not mean the United States should cease supporting the democratic aspirations of Myanmar's people, or that Washington should embrace a regime that has driven a resource-rich country into poverty, used violence to stifle dissent, jailed more than 2,000 political prisoners, deprived its citizens of education and health care, and conscripted children into military service.

But the U.S. policy of isolation is only making the junta more recalcitrant. A member of a foreign intelligence service told me of speaking with a top general, who said, "We are not scared of Western sanctions; we will survive as long as we have rice, salt and ngapi (fermented fish paste)."

Myanmar has endured colonial rule, foreign invasion, civil war and armed insurgency; its intensely nationalistic leaders are paranoid and proud in equal measure. Besides, the junta can count on more than fish paste to see them through: Myanmar has significant natural gas reserves and neighbors happy to trade and invest.

Proponents of sanctions counter that the policy needs more time; that critical loopholes have only recently been tightened; that the answer isn't to lift the sanctions but to bring more countries - especially China - on board. Yet there is no reason to think Beijing would be susceptible to U.S. pressure on Myanmar.

Meanwhile, as Brahma Chellaney, one of India's top strategic thinkers told me, the United States "doesn't have to live with the consequences of its actions," but neighboring countries "will not escape the effects of an unstable Myanmar."

Sanctioning Myanmar may make Americans feel good, but feeling good and doing good are not the same. If the U.S. intent is to improve people's lives in Myanmar, it must find a new way forward.

First, to succeed in Myanmar, U.S. officials must think like the Burmese. Not only have punitive sanctions and relentless public condemnation failed to moderate the regime's behavior, they have pushed the junta further away from the West and into Chinese arms.

Too close a relationship between Myanmar and China is in neither the generals' nor Washington's interests, but the United States has offered only the back of its hand. The U.S. won't even call Myanmar by its name, even though "Myanmar" is the Burmese named for their country, while "Burma" was the name imposed by British colonizers.

As a former Asian diplomat with deep knowledge of Myanmar told me, the people at large "see the West's persistence in calling the country 'Burma' not only as childish and petulant but also as a disrespect to the country and its people." Using "Myanmar" in recognition of the country's difficult history and independence struggle is a gesture that might alleviate some of the junta's suspicion of the outside world.

Second, the United States should increase humanitarian assistance, channeled via the United Nations and NGOs. Myanmar's people endure grinding poverty; their leaders spend only 0.3 percent of GDP on public health, as many as 6 million people lack access to food, and UNICEF reports that 50 percent of infant deaths are from preventable causes. Yet the country receives less than $3 of official development assistance per capita - as compared to $38 for Cambodia and $49 for Laos.

A range of Western donors are already working successfully in Myanmar. In less than two years, the Three Diseases Fund has reached over 93,000 people with HIV prevention activities, provided antiretroviral treatment to 5,500 people living with HIV, supplied over 800,000 people with bed nets, and supported drug distribution to 123,000 tuberculosis patients.

As British Ambassador Mark Canning told me, humanitarian assistance "not only helps people in need, but acts as a medium through which to engage the more constructive elements in government, exposes thousands of young people to the way the foreign relief community works, and reminds them that the international community is out there and there is the promise some day of a more normal relationship." It offers both moral and material solidarity with Myanmar's people.

And they want our help. In my quiet conversations with taxi drivers, shopkeepers and tour guides in Yangon, no one spoke to me of politics. Instead I was asked, "How can I go to your schools? Will America help us get medical treatment?" Ma Thanegi, a former aide to Aung San Suu Kyi who now advocates against sanctions, told me there were only two functioning radiotherapy machines in this Texas-sized country.

Last year, the major headline out of Myanmar was a deadly cyclone. This year, let's hope it will be the winds of change.

Burmese jade business eyes an upswing

Mizzima

by Solomon

March 11, 2009

After nearly a year of negative growth in the trade of jade, Burmese gem merchants are optimistic of a slight increase in business as foreign traders are again returning to the country.

Jade merchants in Mandalay, Burma's second largest city, told Mizzima they have again found some jade buyers, mostly from China, within the past week and are hopeful of an upswing in business.

"We have again seen buyers, after a year of poor business," explained one merchant who wished to remain anonymous.

The source affirmed that most of the traders are from China, but insisted despite the influx of businessmen the Burmese jade industry will still continue to struggle toward a state of normalcy for some times.

"We cannot get the price we expected, as they are buying at a lower price this time," said the source.

She said they can now sell with about half of the price less than the marketing price of the past. Jade stones are currently sold with Burmese Kyat 300,000 (equivalent to US$ 306) while they were worth Kyat 500,000 (US$ 510) in the past when the jade business was well doing.

In Kachin state, the regional center of Burmese jade production, most people including members of the Kachin Independence Army (KIA) rebel group depend on the production and selling of natural resources such as jade, gold and timber for their livelihood. Because of this, the recent prolonged downswing in the trade of jade has hit local communities hard, an economic situation only worsened by the high degree of state control over the business.

In Phakant, the place of main jade production in Kachin State, the business has been badly affected since last November as there was no buyer for green stones. As a result, local people and the merchants struggled for their livelihood.A local businessperson in Phakant said, "Here we could not sell stones [jade] for a long time, it was very difficult to find buyers, though now the situation has improved a little bit."

Yet, the local source continued to speculate on the bleak prognosis for local industry: "The situation will be worse for us in the future, we will have fewer and fewer options by which to gain from this business for our lives."

According to the local source and merchants, the slowdown of business might be the affect of global financial crisis and the US sanctions, which bans buying of jewellery from Burma, an Act signed by former President George W. Bush on July 19.

Another merchant also from Mandalay remarked that traders are happy to again see some buyers, but cautioned it is too early to be overly optimistic about the state of the industry.

Other large jade enterprises in Kachin state include Ever Winner, Myanmar Dagaung and Share Family, each owned by Chinese interests and controlling large swaths of jade mining.

Burma's military government widely promotes, through the Ministry of Mines, jade as a source of income allocating a total of six blocks for the mining of jade in Shan and Kachin states and Sagaing Division (at Mineshu, Namhyar, Moenyin, Mawlu, Mawhan and Khamti) in January of 2009.

Additionally, the military junta has conducted annual gem and jewellery exhibitions in Rangoon since 1964 and later, commencing in 1992, began holding biannual fairs. The emporiums typically earn the junta millions of dollars on each occasion.

The junta announced it had earned more than US$ 172 million from the sale of gemstones in an exhibition of gems and jewellery held in October 2008.

Burma is known for producing some of the highest quality precious stones in the world, including rubies, jade, emerald, topaz, pearl, sapphire and coral.

Retail Gemstone Price Trends (1975-2008)

|